July to September 2022 seafood supply chain analysis: Economic turbulence for seafood

Seafood supply chains are complex and shocks to the supply chain can have wide-ranging effects. Each quarter we look at everything going on in the seafood industry and what affect it has on performance.

July to September 2022: seafood summary

In our last blog, rising prices and the cost of living crisis were starting to take hold across the seafood supply chain. The July to September 2022 period is more of the same with added pressures from inflation rising due to economic turbulence in the UK.

Prices rose further and the cost-of-living crisis worsened during this period, affecting the whole UK seafood supply chain. Prices, especially for food, energy and fuel, continued to rise at a rapid rate. Inflationary pressure increased operating costs for businesses across the supply chain and squeezed consumer budgets, affecting both supply and demand for seafood.

During this period, processing businesses facing increased raw material, food production, energy and transportation costs began to pass these cost increases on to their customers to keep operations viable. Indeed, food and non-alcoholic drinks were the largest contributor to rising prices in July.

With costs rising faster than wages, many households’ food budgets shrank and in August consumer confidence in the economy hit a record low. In response, retailers launched promotions and deals for customers and many shoppers switched to discount retailers.

Strike action across different sectors began during this period in response to the cost of living crisis, with workers demanding inflationary pay raises. Many of these strikes affected the transport and logistics sectors including rail strikes and strikes at major shipping ports.

Labour remained a universal issue across the supply chain. Issues related to staff recruitment and retention as well as difficulty accessing non-UK labour to fill skills gaps. Job vacancies in the hospitality and foodservice sectors were reported as high and rising. Across the processing sector labour remained a limiting factor in production for many businesses. In the catching and salmon aquaculture sectors, the introduction of new restrictions on the use of transit visas was announced by the UK Home Office, raising concerns for businesses reliant on migrant workers for vessel operations.

We’ve summed up the most important events across markets, production and supply from July to September 2022:

Markets

- Sales of seafood in retail continued to decline as the cost of living crisis ate into consumer budgets. However, during July to September shoppers appear to have skipped straight to tinned products (+9% volume), with sales volume of both fresh and frozen seafood down compared to the same period in 2021.

- Market recovery for seafood in foodservice stalled due to cost of living concerns, with visits (-14%) and servings (-15%) down compared to July to September 2021.

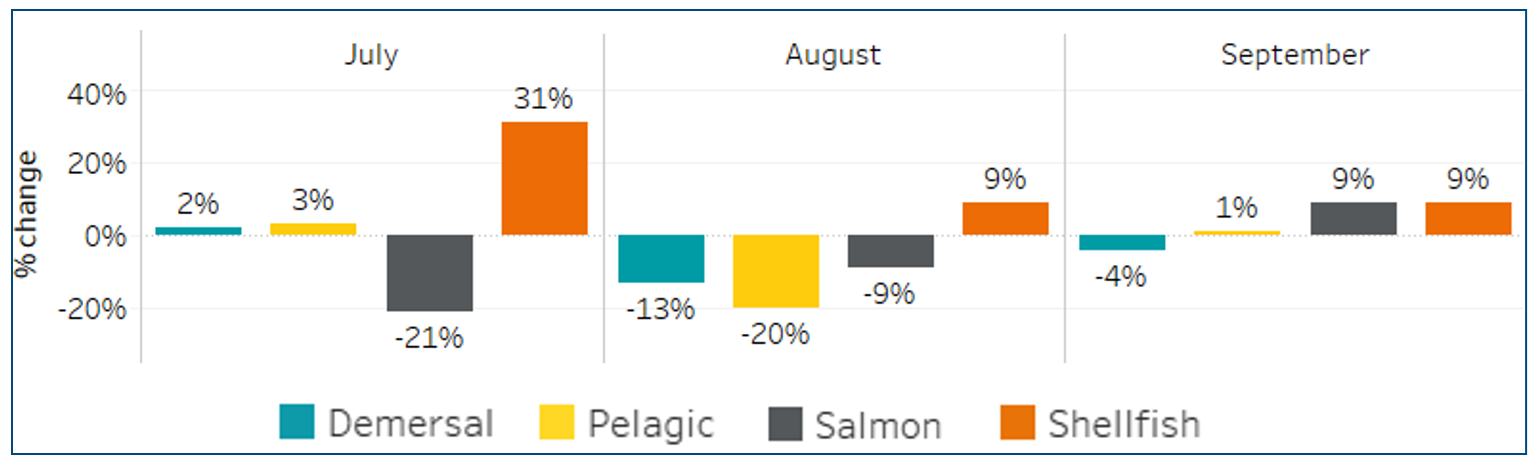

- Shellfish exports were strong during this period, with overall value up 15% during July to September compared to the same period in 2021. Demersal, pelagic and salmon export values were down on 2021 levels. See figure below.

Production and distribution

- Seafood processors continue to face rising raw material costs and labour shortages.

- Labour remained a universal issue across the UK seafood supply chain, with businesses facing challenges with staff recruitment and retention as well as issues accessing non-UK labour to fill skills gaps.

Supply and primary production

- An added 35% tariff on Russian whitefish imports was introduced during this period, further increasing demand (and prices) for non-Russian whitefish. This was reflected in average whitefish import prices up 39% compared to July to September 2021.

- High fuel prices and concerns about access to fishing grounds, quota and the quality of certain stocks and fisheries were cited by the catching sector during this period.

- Shellfish farmers continued to face reputational issues related to poor water quality, while the Scottish salmon sector continued to face labour issues.

Full data and analysis are available from our PDF report and on our interactive dashboard on Tableau.

Seafood industry data and insight

We publish a suite of reports, dashboards and infographics about the UK seafood industry.

Our UK Seafood in Numbers 2021 infographic is a good overview of the whole UK seafood supply chain and how it’s performing on a yearly basis. Follow the link below to access the infographic.

Earlier quarterly reports are also available on the page.

If you want more detailed data and analysis which is sector specific, follow the links below to the relevant page:

-

Fishing data and insight

-

Aquaculture data and insight

-

Seafood processing data and insight

-

Seafood trade data

-

Seafood retail data and insight

-

Seafood in foodservice data and insight

Share your thoughts

We are always seeking ways to improve our offering to the seafood industry. We would welcome any feedback on the dashboards and the reports. You can use the React and Share buttons below or email seafish@seafish.co.uk.