2023 April to June supply chain analysis: Inflationary pressures continue

Seafood supply chains are complex and shocks to the supply chain can have wide-ranging effects. Each quarter we look at everything going on in the seafood industry and what affect it has on performance.

April to June 2023: Seafood summary

Cost pressures continued to impact the whole UK seafood supply chain. Inflation in the UK remained stubbornly high, falling from 7.8% in April to 7.3% by June, exacerbated by inflation in the food sector. This led the UK government to apply pressure to the supermarkets to get prices down. In May, the government considered capping the price on basic food items. In June, supermarket executives were challenged by MPs on the speed at which they were passing on price decreases to consumers.

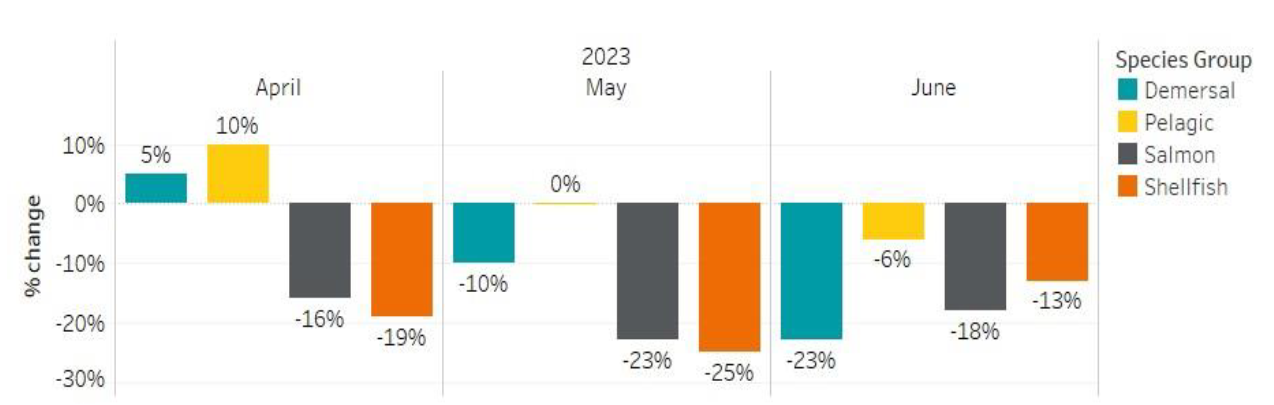

Squeezed both by their buyers in the retail sector, and with high raw material and energy costs, processors came under pressure. This is borne out in the import trade data as import volumes of cheaper white fish, like Alaskan pollack grew, which was also reflected in increased retail sales of products containing these lower value species. Over the same period the value of imports increased driven by price inflation. However, the volume of imports decreased at the same time. A similar story of higher value but lower volume was also occurring in exports.

The increased cost of seafood, while below the average inflationary rate for all food products, contributed to the accelerated decline in the seafood consumption in retail. In foodservice, visits and servings were improving over the previous year, but were not yet back to pre-covid (2019) levels. Recovery in foodservice was driven by consumer need for value for money, convenience, and a desire to socialise.

Labour was another pressure across the supply chain. The catching sector was affected by the changes in visa rules brought into force with the Nationality and Borders Act 2022. The changes confirmed that migrant crew working on vessels inside 12nm should be employed under a skilled worker visa. This led to some boats having to tie up because they could not source crew that met the visa requirements, border force patrols removing migrant crew from vessels, and owners and skippers becoming sponsors to bring workers in on skilled worker visas. There was some good news from the Migration Advisory Committee (MAC) consultation with deckhands, trawler skippers and share fishermen added to the shortage occupation list (SOL).

Calls for processing jobs to be added to the Seasonal Workers Scheme highlight the pressures faced in the processing sector. The impacts of inflation and the cost-of-living crisis saw employees moving jobs to secure wage increases.

We’ve summed up the most important events across supply, production, and markets from April to June 2023:

Seafood supply

- The volume of seafood imported to the UK experiences one of the steepest declines of the past decade despite price inflation beginning to ease.

- Total import value of seafood remained in growth as all species groups continued to experience price inflation increased development of aquaculture farms on land.

- Successful sustainability measures see the return of spurdog.

- Scottish government rolls back plans for Highly Protected Marine Areas (HPMA)s.

Production and Distribution

Cost pressures, especially from energy, transport and inflation, continue to impact the processing sector, from both the supply and demand sides.

Recruitment remains a challenge across the entire supply chain Catching sector is required to use skilled worker visas, but jobs are added to the shortage occupation list.

Markets

- Seafood inflation is well below the average food inflation rate, yet UK retail seafood consumption is in decline.

- Consumers are shopping around and looking at cheaper alternatives including ‘dine in’ options, trading down or even out of seafood for cheaper proteins.

- The foodservice sector continued to recover with a 9.8% increase in visits on the same period in 2022.

- Seafood was up 6.7% for servings Out of Home (OOH).

- Seafood export value growth continued driven by price inflation, with the most notable growth in trout .

- Overall, a lower volume of seafood was exported from the UK compared to the year before.

Full data and analysis are available from our PDF report and on our interactive dashboard on Tableau.

-

Go to Quarterly Seafood Supply Chain Overview on Tableau

-

Click here to download our latest supply chain analysis report

Seafood industry data and insight

We publish a suite of reports, dashboards and infographics about the UK seafood industry. If you want more detailed data and analysis which is sector specific, follow the links below to the relevant page:

-

Fishing data and insight

-

Aquaculture data and insight

-

Seafood processing data and insight

-

Seafood trade data

-

Seafood retail data and insight

-

Seafood in foodservice data and insight

Share your thoughts

We are always seeking ways to improve our offering to the seafood industry. We would welcome any feedback on the dashboards and the reports. You can use the React and Share buttons below or email seafish@seafish.co.uk.