2023 January to March supply chain analysis: Costs and labour concerns

Seafood supply chains are complex and shocks to the supply chain can have wide-ranging effects. Each quarter we look at everything going on in the seafood industry and what affect it has on performance.

January to March 2023: Seafood summary

From January to March, the UK seafood supply chain felt the impact of soaring prices, affecting various parts of the chain differently. Consumers responded by either reducing their seafood purchases in retail or switching to non-branded or discounted products. Retailers, in turn, tried to retain customers by offering deals and price matching. Some also collaborated with seafood processors to adapt their products, focusing on more affordable or readily available species, particularly for frozen whitefish products.

Small business owners were notably lacking in confidence during this period, with concerns about potential business closures in 2023 due to rising costs.

Recruitment and staff retention remained a significant challenge throughout the supply chain in the first quarter of the year. In February, the Migration Advisory Committee sought input from businesses and industry representatives to add specific job roles, such as deckhands and factory floor workers, to the Shortage Occupation List.

The catching sector expressed concerns to the government about proposed changes to the Transit Visa system, which could prevent crew members from working in UK territorial waters on a Transit Visa. Our labour survey indicated that most employers relying on Transit Visa Crew were not preparing to change. Some mentioned the need to shift to Skilled Worker visas because they operate within 12nm.

We’ve summed up the most important events across supply, production and markets from January to March 2023.

Seafood supply

- The total volume of seafood imported to the UK was lower than in the first three months of 2022, driven by a decrease in the volume of imported salmon and shellfish species.

- Processing facilities in China and Vietnam boosted production of pangasius and Alaskan pollock to meet increased demand for affordable whitefish alternatives to cod and haddock.

- Water quality remained an issue for many shellfish aquaculture businesses.

- Though overall average prices remained high for whitefish and shellfish species, the UK fleet continued to struggle with cost pressures, labour shortages and concerns about fishing restrictions.

Production and Distribution

- Processing businesses were squeezed by cost pressures on both the supply and demand side during this period.

- Strike action continued during this period, disrupting supply chain logistics across the UK border.

- Recruitment and retention remained a challenge for businesses across the UK seafood supply chain.

Markets

- The decline of seafood consumption in retail continued to accelerate even as seafood price inflation remained much lower than other foods.

- Despite challenges from the cost-of-living crisis the foodservice market continued to recover in January to March 2023, up 3% in visits on the same period in 2022.

- Seafood was growing ahead of the total food and drink market with servings of seafood up 14% compared to the same period in 2022.

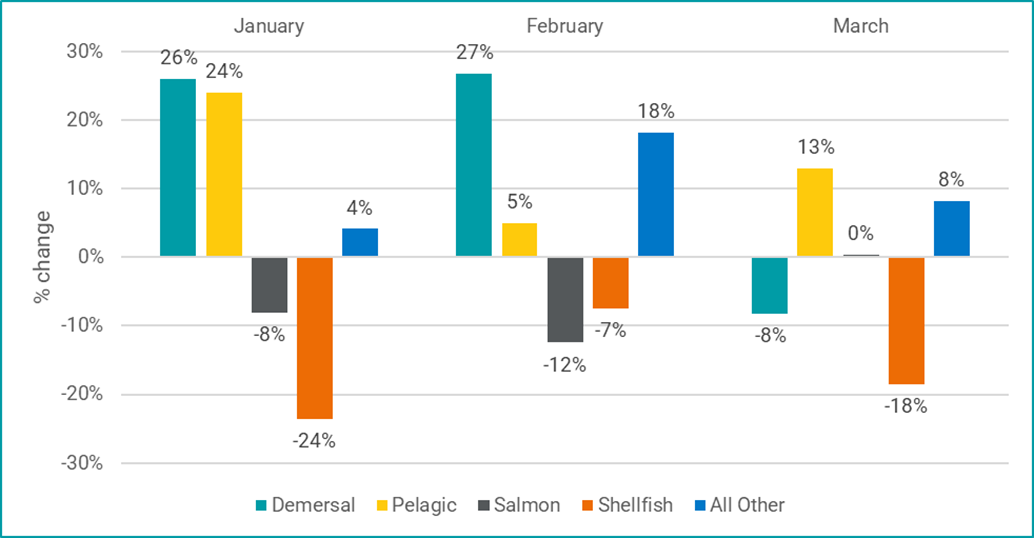

- Compared to the same period in 2022, total seafood export value continued to grow (+8%) even as price inflation slowed down. An increase in export volume in January to March 2023 reversed a longer-term decline.

- Seafood export value to the EU stayed at similar levels to 2022 as exports to non-EU markets grew. The proportion of exported seafood value to the EU dropped from 68% to 62%.

Full data and analysis are available from our PDF report and on our interactive dashboard on Tableau.

Seafood industry data and insight

We publish a suite of reports, dashboards and infographics about the UK seafood industry. If you want more detailed data and analysis which is sector specific, follow the links below to the relevant page:

Seafood processing data and insight

Share your thoughts

We are always seeking ways to improve our offering to the seafood industry.

We would welcome any feedback on the dashboards and the reports. You can use the React and Share buttons below or email seafish@seafish.co.uk.