Revision to proposed changes to Seafish levy following industry feedback

The board is proposing changes to the levy following industry feedback that the levy needed to be fairer and more equitable. The last levy change was almost 25 years ago and has contributed to a reduction in our spending power of almost 55%. The proposed changes aim to ensure we can continue our current support for the industry and increase support where the seafood industry needs it most.

The levy is paid on the first sale of seafood in the UK. Different species pay different rates and not all species are included in the levy such as freshwater fish like salmon, trout and tilapia. Some imported product formats are excluded too such as imported canned and bottled fish.

Consultation feedback

The Seafish Board held an informal consultation on proposed levy changes with the seafood industry earlier this year. The Board considered the feedback during the consultation and have published a full response with some revisions to the proposed changes to the levy. These are still proposals, and no decision will be taken by Ministers on amending the levy until after the formal statutory consultation in 2024.

The Seafish Board’s revised levy proposal includes:

- A reduction in proposed levy increase on pelagic species, cockles, whelks and mussels from 1p per kg to 0.5p per kg. The levy increase for pelagic species, cockles and mussels would be phased in over three years.

- Levy would be taken on imported canned, bottled and preserved species containing levy species.

- Inflationary adjustment of 2% each year would be implemented to ensure levy value does not decrease in value over time.

- A minimum levy threshold (a de minimus level) of £100 per year meaning businesses would not pay if levy due is below £100 would be introduced. It is estimated that 22% of businesses that currently pay the Seafish levy would benefit from this and would no longer need to pay levy.

- Salmon, trout and other freshwater farmed species will remain out of scope from the levy review as they are explicitly excluded in the 1981 Fisheries Act.

A full response to the informal consultation with revised proposals for levy changes is available on our Levy Review webpage. This proposal will form the basis of a formal consultation on the Seafish levy in 2024 where the seafood industry will have another opportunity to provide feedback.

Additional levy benefits

We published our 2023-2028 Corporate Plan earlier this year detailing the our roadmap on how we can support the seafood industry across the UK to thrive.

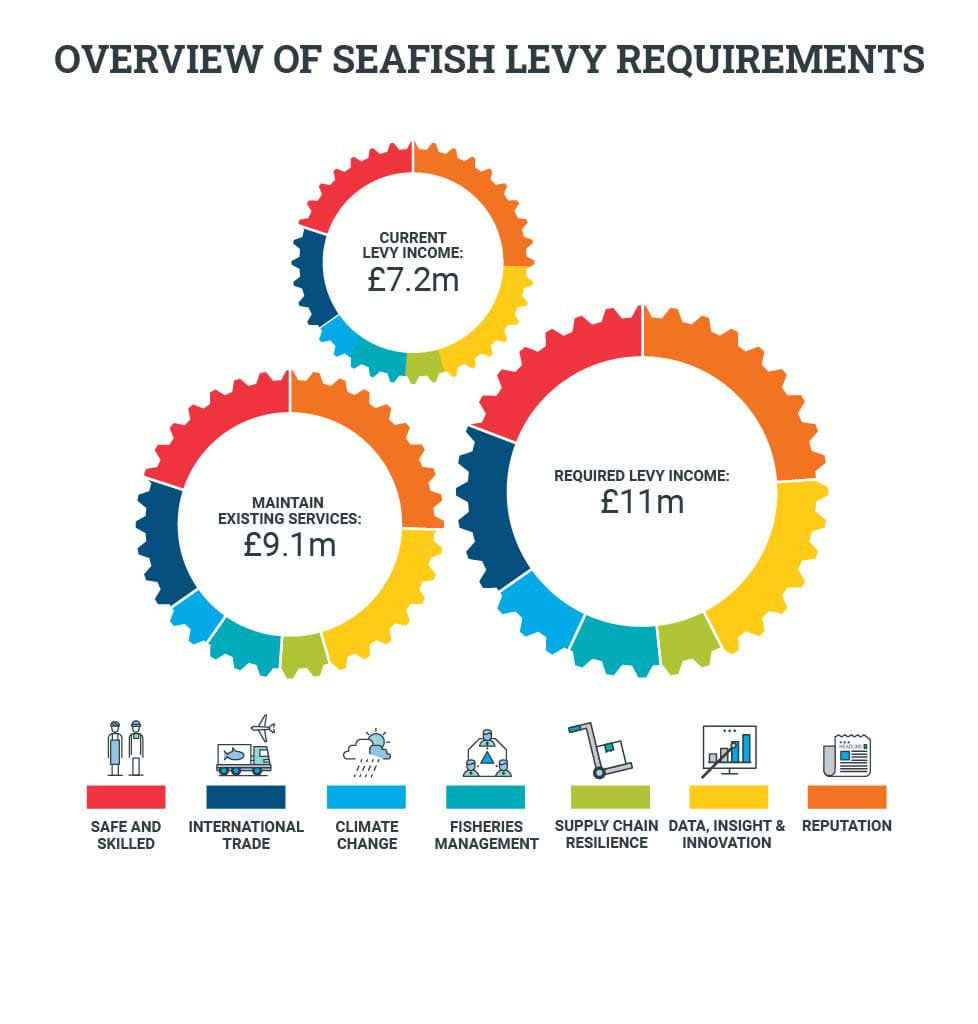

At Seafish, we currently take £7.2m per year in levy but we need an income of £9.1m per year to maintain existing services in the future. An annual income of £11m per year would provide additional funds to deliver extra support.

Additional levy funds will be used to give the seafood industry more support in the areas identified as priorities by the industry during our Strategic Review in 2021. The extra levy will help to fund:

- Additional expertise to help businesses across the supply chain to respond and adapt to the climate change emergency.

- Assisting seafood business to respond to emerging issues; geopolitical or economic events, environmental issues, or consumer issues that influence demand.

- ‘On the ground’ fishing safety advisers to support the UK fishing fleet.

- Greater capability to support businesses to tackle labour issues, whether that’s recruitment challenges or addressing welfare and ethical issues across the supply chain.

- More international trade shows, and additional resources to assist businesses in overcoming trade barriers and produce trade analysis to support decision making.

- A fully funded fisheries management team to facilitate industry involvement in fisheries management decision making and provide analysis and advice. Any work that we are commissioned to deliver on Fisheries Management Plans for government is not funded from levy.

- More capacity to proactively support the industry in challenging misinformation on issues affecting industry reputation.

- Additional economic analysis expertise to respond to industry queries.

- Expanding the GIS team to offer stakeholders a spatial analysis service to help decision making.

During our recent Strategic Review, the seafood industry told us they wanted a fairer and more equitable Seafish levy system. The industry also told us it needed our support more than ever to deal with the challenges and pressures they face and to help them to thrive into the future.

“Seafish needs levy to operate. The last change to the levy was in 1999 and if rates had moved with inflation, then Seafish’s levy income would now be worth £16.8m. This equates to a reduction in our spending power of almost 55% which is eroding our capacity to deliver the support the industry wants and needs.

“Based on feedback from the industry, we are proposing changes to the Seafish levy to ensure we can continue to deliver the valuable work we do to help the seafood industry to thrive.