What happened to whitefish imports last year

It’s now been over a year since the Russian invasion of Ukraine and 10 months since the UK brought in sanctions, with an additional 35% tariff on seafood imports from Russia. I’ve taken a look at the data on whitefish species usually imported from Russia to see how things have changed over the last year.

UK imports of cod, haddock and pollock 2022 vs 2021

In 2022, the UK imported £3.6 billion worth of seafood from around the world for food use. Cod, haddock and pollock made up almost a quarter of this at £886.7 million for a quantity of 164,477 tonnes.

These 3 species make up 86.2% of the total imported demersal value, which is just under £1.03 billion. A breakdown of 2022 demersal imports by species is included in the table below:

| Species | Import value £'million | Proportion of total UK demersal imports % |

| Cod | £564.1 | 54.8% |

| Haddock | £234.1 | 22.7% |

| Pollock | £88.5 | 8.6% |

| Seabass | £42.6 | 4.1% |

| Sea Bream | £21.3 | 2.1% |

| Hake | £12.9 | 1.2% |

| Plaice | £12.5 | 1.2% |

| Halibut | £8.7 | 0.8% |

| Saithe | £6.3 | 0.6% |

| Redfish | £5.8 | 0.6% |

| Toothfish | £2.6 | 0.3% |

| Grenadier | £2.5 | 0.2% |

| Turbot | £2.2 | 0.2% |

| Monkfish | £2.2 | 0.2% |

| Sole | £1.4 | 0.1% |

| Dogfish | £1.1` | 0.1% |

| All Other | £20.4 | 2.0% |

| Demersal total | £1,029.0 | 100.0% |

Prices rose throughout 2022 for imports of cod, haddock and pollock, increasing an average of 29% by the end of the year. This resulted in lower volumes of cod (-12%) and haddock (-11%) imported compared to 2021. Pollock also experienced a similar price rise, but the volume imported increased by 31% compared to 2021. Pollock is the cheaper whitefish option of the 3 and is possibly being used as a replacement for lost volumes of cod and haddock imports. The change in import value, volume and prices for each of these species between 2021 and 2022 is shown in the table below.

| Value £m | Volume, tonnes | Price £/kg | % Change 2022 vs 2021 | ||||||

| 2021 | 2022 | 2021 | 2022 | 2021 | 2022 | Value | Volume | Price | |

| Cod | 490.3 | 564.1 | 96,373 | 84,803 | 5.09 | 6.65 | 15% | -12% | 31% |

| Haddock | 198.1 | 234.1 | 61,434 | 54,720 | 3.22 | 4.28 | 18% | -11% | 22% |

| Pollock | 51.7 | 88.5 | 19,861 | 25,954 | 2.60 | 3.41 | 71% | 31% | 31% |

| Grand Total | 740.1 | 886.7 | 177,669 | 165,477 | 4.17 | 5.36 | 20% | -7% | 29% |

The price of importing whitefish in 2022

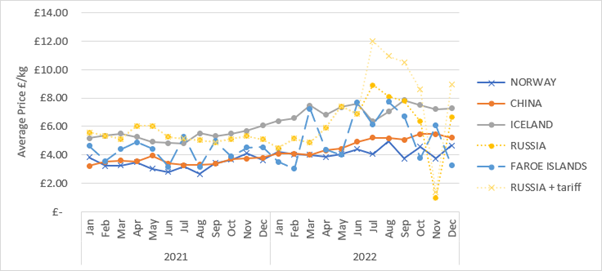

The disruption to the UK supply of whitefish resulting from sanctions is still being assessed. The additional 35% tariff on Russian origin seafood imports was implemented in July 2022, but before this came into play, import prices of cod, haddock and pollock from all major supplying countries had been rising (see figure below). As noted in Undercurrent News, rising prices for Icelandic cod have been attributed to lower volumes of cod landings due to both cuts in Barents Sea quota and high demand.

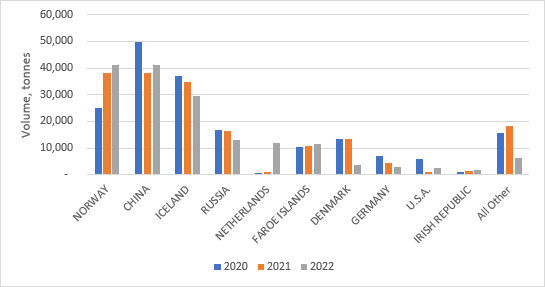

About half of all cod, haddock and pollock imports (by volume) came from Norway and China in 2022, with both countries increasing their market share compared to 2021 (see figure below). Imports direct from Russia made up 9% of all UK’s cod, haddock and pollock imports in 2021, this reduced to 8% by the end of 2022.

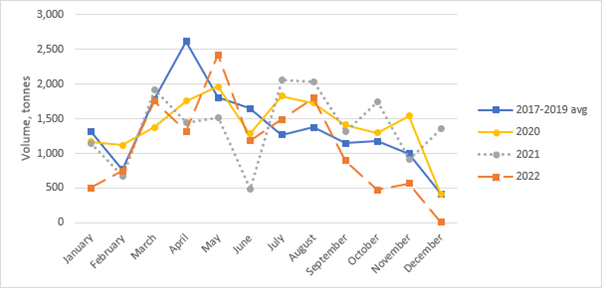

By the end of 2022, the volume of whitefish imported from Russia was 21% lower than it was in 2021. There was no observed sudden drop in import volume in July, instead it isn’t until September 2022 that we start to see a meaningful decline in the trade statistics. This may be due to stockpiling of Russian whitefish before tariffs came into play, which was then released from cold stores into circulation between July and September.

The import volume of whitefish from Russia in December of 2022 was 12.7 tonnes, which was 99% lower than in December 2021. If this decline in import volumes continues into 2023 then it suggests that the tariff has curtailed direct trade with Russia

By the end of 2022, importing whitefish from Russia cost an average of £6.61/kg excluding the 35% tariff. Including the tariff would result in an additional £2.31 per kilo, making Russia the most expensive of the top whitefish supplying countries at £8.92/kg. In the 5 months between August and December the additional cost of the 35% tariff on cod, haddock and pollock imports from Russia totalled £8.8 million. The average price for importing whitefish (cod, haddock and pollock) in 2022 from each country is given in table below.

|

Country of Consignment |

Average whitefish import price 2022 (£/kg) |

|

NORWAY |

£ 4.20 |

|

CHINA |

£ 4.81 |

|

ICELAND |

£ 7.09 |

|

RUSSIA |

£ 6.61 |

|

FAROE ISLANDS |

£ 5.88 |

|

RUSSIA + tariff |

£ 8.92 |

How sanctions have impacted trade

The additional 35% tariff on Russian seafood is being applied to direct imports. This is fish that comes straight from Russia to the UK. This mainly applies to frozen at sea fillets destined for fish and chip shops and as such it is having a bigger impact on these smaller businesses. Most product destined for retail is processed via another country – China mainly, but also in Vietnam and Europe. The additional tariff is not applied on this product and it is mostly being imported by larger companies.

The implementation of UK trade sanctions with Russia are only part of the story for whitefish imports. Seafood is a global commodity and over the last 12 months trade has also been influenced by how other countries have responded to the Russian war in Ukraine. For example, the US implemented restrictions on Russian imports before the UK. Trade from China was also constrained by extensive Covid-19 lockdowns in the main seafood hub.

Find out more

More information on UK imports and exports of seafood is available from the link below: